tax avoidance vs tax evasion uk

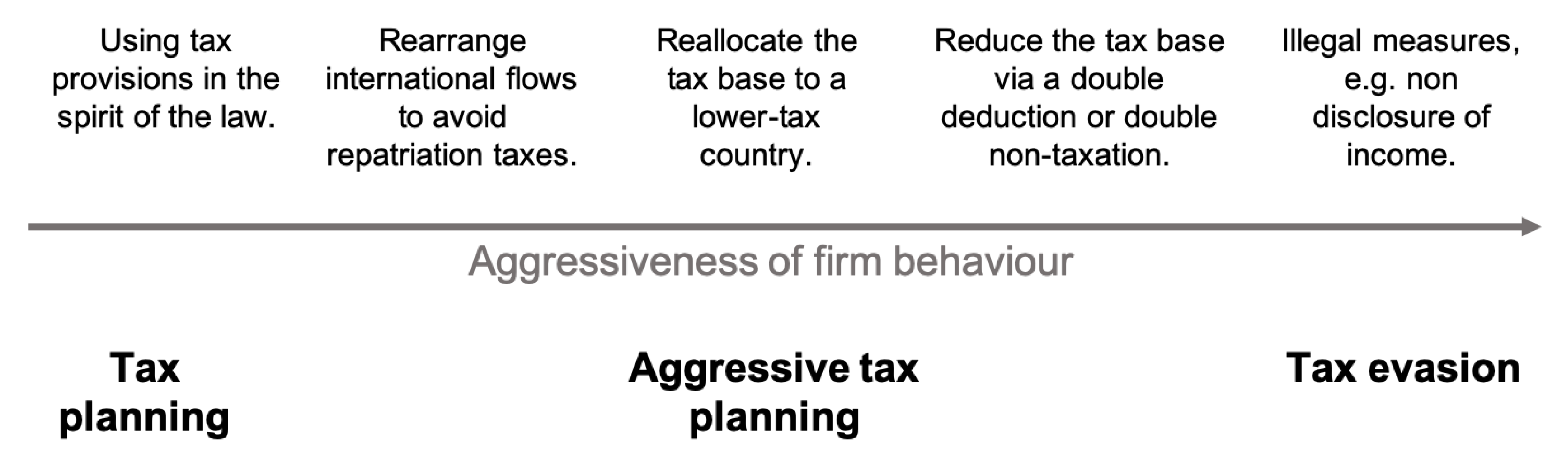

Tax avoidance has always created interesting news. The difference between tax planning and tax avoidance is that tax avoidance always increases your tax risk.

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Basically tax avoidance is legal while tax evasion is not.

. Tax evasion is ILLEGAL. Its as simple as that. In September 2021 HMRC published revised estimates which put the tax gap at 35 billion for 201920 representing 53 of total tax liabilities.

Avoiding tax is legal but it is easy for the former to become the latter. In the UK income tax evasion may result in a maximum penalty of seven years in jail. Tax avoidance are unethical since it attempts to manipulate the system without inflicting any harm.

The terms tax avoidance and tax evasion are often used interchangeably but they are very different concepts. In addition Annex A lists details of over 100 measures the government has introduced since 2010 to crack down on avoidance evasion and non-compliance and Annex B. Tax planning either reduces it or does not increase your tax.

0800 788 887Outside UK. 2 The tax gap 3 The Coalition Governments approach. Tax avoidance may exist in a controversial area of the tax system but tax evasion most definitely doesnt.

On 16 Feb 2022. It is the illegal practice. 44 203 080 0871Monday to Friday 9am to 5pmFind out about call charges.

It always creates a lot of anger and questions about how to get away with. The difference between tax avoidance and tax evasion is that tax avoidance schemes operate within the law but are described by HMRC as not being in the spirit of the. What is tax avoidance and what is tax evasion.

It even makes big news for celebrities and large multinationals. This is much easier to define as to have. But some businesses and individuals go much further to minimise their tax liabilities which can give rise to accusations of tax avoidance if not blatant tax evasion.

The difference between tax avoidance and tax evasion essentially comes down to legality. It is estimated that in 201920. Fraudsters who carried out a 100 million tax avoidance fraud have been sentenced to 27 years in prison.

Tax avoidance is structuring your affairs so that you pay the least. Some Major Differences Between Tax Evasion and Tax Avoidance. If you are facing charges of tax evasion or tax fraud it is imperative to have experienced attorneys on your side every step of the way.

The attorneys at Weisberg Kainen. According to most recent. Tax evasion is when individuals or businesses deliberately decide to commit a crime and allow illegal actions to take place to avoid paying tax.

The difference between tax evasion and tax avoidance largely boils down to two elements. Tax avoidance and tax evasion Summary 1 Introduction. HMRCs work on the tax gap.

The tax evasion vs tax avoidance debate is a long-standing one. Whether its famous musicians footballers or global businesses in recent years HMRC have made it a priority to clamp down.

Tax Evasion Vs Tax Avoidance 4 Rules You Should Follow Youtube

Income Tax And Ni Basics 2020 Income Tax Income Business Infographic

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Vs Tax Evasion What S The Difference

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Tax Evasion And Tax Avoidance Explained Pdf Tax Avoidance And Tax Evasion Explained And Studocu

Benefits Fraud Vs Tax Evasion Cost To The British Taxpayer R Labouruk

Your Thoughts Tax Avoidance Offshore Loopholes

Tax Avoidance Vs Tax Evasion Infographic Fincor

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Tax Avoidance Costs The U S Nearly 200 Billion Every Year Infographic

Pdf Tax Evasion Tax Avoidance And Tax Expenditures In Developing Countries A Review Of The Literature Semantic Scholar

Tax Avoidance Tax Planning And Tax Evasion What S The Difference The Accountancy Partnership

Tax Avoidance Is Not Tax Evasion But Try Telling Politicians Private Banking Asset Protection And Financial Freedom